By now, it’s likely that you’ve heard that the 2017 TCJA tax reform increased the estate, gift and generation skipping transfer tax exclusions from $5 million to $10 million per taxpayer. After inflation adjustments, the 2019 exclusions are $11.4 million for a single taxpayer and $22.8 million for married taxpayers. Also, by now 99% of you have likely heard that this increase means your estate won’t be paying these transfer taxes inter-vivos (during life) or upon your death, thus estate planning to avoid estate taxes has become practically obsolete. Your advisors may have even ignored the estate planning topic with you based on these changes. RDG+Partners, PLLC is not one of these advisors. We’re here to remind you that if you live in a State that has its own estate and/or inheritance taxes, you may very well have a taxable estate. New York State is one of these States, with an exemption of $5,740,000 for deaths occurring in 2019. In addition, we are here to help you understand the relevance and importance of estate planning beyond transfer taxes and how in some respect estate planning has become even more important now than it ever was.

Let’s get something straight. Estate planning isn’t just for the affluent. Every person who has an estate should maintain some level of estate planning. Before you ask if you have an estate, the answer is yes, you do. Defined as all the money and property owned by a person at death, unless you pass naked somewhere in the Bush with no connection to society, you have an estate. And if that’s the case then you’re not reading this anyway.

So now that we’ve determined that everyone reading this has an estate, let’s consider some reasons why you need some estate planning. We’ll discuss the topics bulleted below in further detail but keep in mind that this list is non-exhaustive. The extent and character of estate planning varies between individuals and should be customized around personal wishes and circumstances.

- Planning for loved ones beyond your death

- Planning for Federal Estate, Gift, Generation Skipping Transfer taxes

- Planning for State Estate and Inheritance Taxes

Lastly, you’ll find our sales pitch followed by a short checklist of highly recommended items for those who are just getting started. Feel free to skip to the checklist but not over the sales pitch.

Planning For Loved Ones Beyond Your Death

Estate planning in its simplest form involves deciding who will receive your assets after your death. A Will is the standard document used to carry out such wishes. What happens if you pass away without a Will? Assuming you own real estate of any value or your total personal property value surpasses a low dollar threshold set by the State ($30,000 for New York) then your money and property will be directed by the Court in proceedings known as Probate. The Court will choose an executor for you, who will then be directed to distribute your property according to the State laws in which your property resides. Not terrible if you’re indifferent to who becomes the executor of your estate or who gets your assets. Now is a good time to let it be known that any interested person can petition to be your executor or one of your heirs during Probate proceedings without a Will. Yikes! The easiest way to prevent this is to create a Will which allows you to choose your own executor and direct your property to the heirs of your own choosing. The Probate Court will then examine the validity of your Will and use it to carry out your wishes. You read that correctly. Even with a Will the Courts are involved in administering your estate. Is that bad?

It’s generally advisable to avoid Probate. Why? First and foremost, it’s expensive, on average, costing between 2% – 7% of the gross estate. Remember that time you were advised to draft a Will because it was the cheapest form of estate planning? That may be true while you’re alive but I’m certain that nowhere in your Will did you state that you wanted the Probate Court to be the heir of 2% – 7% of your total assets. Secondly, it’s public record. That means anyone and everyone can see what assets you had and to whom they were distributed. Lastly, the process can take anywhere from a few months to a few years to finalize. To complicate things further, if you happen to have property located in more than one State you could be dealing with multiple probate proceedings and the laws of various States at the same time.

For some, the disadvantages of Probate are not enough to go beyond the drafting of a Will. That’s okay, we’ll still work with you. But for those of you who do find the disadvantages of Probate to be more than simply unattractive, consider drafting a living trust. A living trust, while very similar to a Will, avoids Probate, is generally less expensive for the executor to administer and your estate remains out of public record. Typically, it’s advisable to create both a will and a living trust that mirror one another. That way, if an asset doesn’t get properly titled to the living trust, it will pour over to be directed by your Will.

Once you’ve chosen your document(s) of choice, it’s imperative that you keep them up to date. Life events and law changes occur frequently enough that neglecting to revisit your estate plan at least every 3 to 5 years may leave your plan outdated with unintentional consequences. Not surprisingly, we urge all our clients to revisit their plans after the 2017 TCJA tax reform to make sure any strategy used still makes sense.

Other ways to avoid probate include adding joint owners with the right of survivorship to your assets (typically used with bank accounts and real estate but be weary of potential gifting issues) and utilization of beneficiary designation forms (typically used with retirement accounts and life insurance). In both instances, upon your death the assets will go to either the joint owner or the beneficiary you’ve designated with no need to go through Probate. It’s notable that neither of these should be considered viable asset protection strategies. Adding joint owners opens the door for creditors of the joint owner during lawsuits. Beneficiary designations override all else, even a will or trust, thus any assets sent immediately to the selected beneficiary upon your death is fair game in any lawsuit they may be in with creditors. For these reasons, it is imperative that you take care in completing these and revisit them from time to time to make sure they still make sense given your current life situation.

It is also worth noting that minors cannot inherit assets or property. Any assets designated to a minor will get kicked back into probate court where an UTMA account will be set up for the minor until the minor reaches the age of majority. Proper trust planning in your estate can avoid this result.

Planning for Federal Estate, Gift, and Generation Skipping Transfer Taxes

Here it is. The section that 99% of you will skip over thinking this doesn’t apply to you after the increase in exemptions. Not so fast. There are traps that if you’re not aware of and plan around, may result in you becoming part of the minority that is subject to these taxes. But first, let’s define what exactly these taxes are and look at the 2017 TCJA law changes surrounding them.

What exactly is the estate tax? According to the IRS, the estate tax is a tax on your right to transfer property at your death. Upon administration of your estate, this is where your executor may find your long lost, slightly deranged, and overly complex, Uncle Sam now penciled in under the beneficiary section. More easily understood, the estate tax is a tax levied on the taxable estate of a deceased person before distribution to their heirs. Your taxable estate is first computed by totaling the fair market value (not what you paid) of all of your assets (i.e. real estate, cash, retirement accounts, investments, business interests, personal effects, life insurance, some trusts, literally everything, etc.) on your date of death (or the alternate valuation date if elected) and subtracting out any debts, administrative expenses, transfers to charities, and assets going to your surviving spouse. Any lifetime taxable gifts that you’ve made after 1977 are then added to this amount to get to your taxable estate.

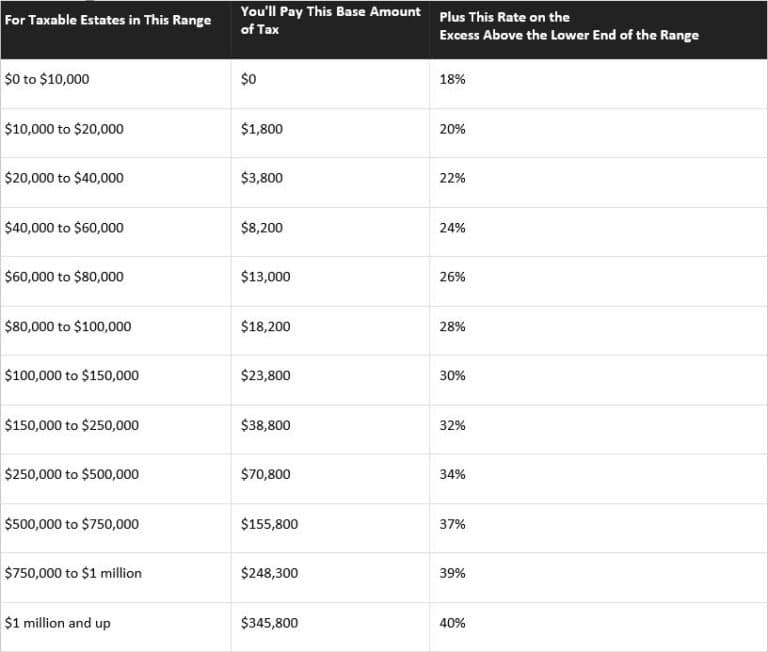

You’ll notice in the table above that tax is computed on taxable estates as low as $1. You’re not seeing things. If you die with at least $1 to your name, your estate is taxable. But that goes against everything you’ve heard and read. You’re right, there is a catch. That catch is what’s called the applicable credit amount (formerly called the unified credit amount). To figure out the applicable credit, you first need to start with what’s called the basic exclusion amount. This is the amount that you hear discussed in the news and was recently given a

huge increase due to tax reform. The basic exclusion amount for 2019 is $11.4 million for a single taxpayer, adjusted annually for inflation. By running this amount through the table above, the applicable credit can be determined as $4,505,800 for a single taxpayer. What this means is that if you were to die in 2019, and your taxable estate was less than $11.4 million, you’d be covered by the applicable credit in full, thus could take out that old school pink pearl and erase Uncle Sam from your Will. Bottom line is that any taxable estate over $11.4 million is taxed at a rate of 40% for every $1 over $11.4 million for 2019.

If you’re in that 99% group and you’ve stuck with us this far, most of you are still wondering why you did, and the rest are wondering where the other $11.4 million of lifetime exclusion for your spouse went. Most of you will have to continue to be patient while we address the missing spousal exclusion. Yes, it’s true, if you’re married you might be able to quickly look at the $11.4 million, double it, realize you’ll likely fall under a $22.8 million taxable estate and carry on with the assumption that you’re done. Here’s where we point out something that is often overlooked regarding combining lifetime exclusions with your spouse. It’s not automatic. That’s right. If your spouse passes away before you, you don’t automatically receive their unused exclusion to apply against your own estate. Rather, this is an election called portability that must be made on a timely filed, including extensions, Form 706: United States Estate Tax Return when your spouse passes away. Without making this election you are not able to use your spouses unused exemption for your own estate. Luckily, the IRS has provided relief in Revenue Procedure 2017-34 for those who have neglected to make this election timely. Contact us immediately if this applies to you.

Ahh the moment why you’re still here has arrived. Wait for it…..(ok, you already did)… the $11.4 million basic exclusion, adjusted for inflation, is only here temporarily. It’s set to sunset in 2026 back to pre tax-reform amounts of $6 million and could change prior to then with the big election on its way in 2020. Simply put, drastically more taxpayers would be impacted by a reduction in the basic exclusion that could occur at any time.

But if you’re not planning on dying before 2026 you may think that you have no control over how these exclusion amounts impact you. Drumroll please. You do! And more so than ever! The basic exclusion amount covers lifetime transfers as well as at death transfers. This is where a strong gifting strategy may come into play. We’ll get into what exactly gifting is in a moment but theoretically, if you were to gift aggressively between now and 2026 and apply $11.4 million of your lifetime exclusion to your taxable gifts, when you pass in 2027 and the exclusion has dropped back to $6 million, you’ve taken advantage of an additional $5.4 million in exclusions that no longer exist! Before you ask if the IRS will tax you on that $5.4 million, I’ll point you to the IRS proposed regulations issued on November 23, 2018 where the IRS addressed this issue and concluded that there will be no clawback of the exemption for those who utilize it through 2026. Huh. There are a lot of things to consider here. Most notably the loss of basis step-ups by employing this strategy, but for those opportunists out there, let’s talk!

Now is a good time to talk a bit about the gift tax. First, a gift is any transfer of real or personal property, whether tangible or intangible, in trust or by any other means, either directly or indirectly, where full consideration is not received in return. Did you think your generosity would come with no consequences? At the very least if someone is going to get taxed on your generosity, wouldn’t it be the person you gave the gift to? Let’s clear this up. The general rule is that all gifts are taxable and they’re taxable to the donor (that’s you in this scenario), not the person in receipt of the gift.

The good news is that with every other part of tax law, there are exceptions.

The following gifts are non-taxable:

- Gifts of a present interest that are not more than the annual exclusion for the calendar year. For 2019, the annual exclusion is $15,000. What this means is you can gift up to $15,000 per individual to as many people as you’d like and not have to pay gift taxes. This exclusion amount doubles to $30,000 if you and your spouse choose to split gifts or if you live in a community property state and you gift community property.

- Transfers to political organizations defined in section 527E(1)

- Transfers to certain exempt organizations defined 501C(4) – 501C(6)

- Payments of tuition only (not school supplies, room and board, etc.) made directly to the educational institution on behalf of an individual

- Payments made directly to a person or institution on behalf of an individual for medical care that qualifies under section 213D and not otherwise reimbursed by insurance.

- Gifts to your spouse unless your spouse is not a U.S. Citizen and your gifts to them during the year were greater than $152,000 for 2019.

- Gifts to qualifying 503(b) charitable organizations

The above items while not taxable, still may carry reporting requirements on Form 709, including a variety of elections that may be considered. I won’t get into the nitty-gritty of what those are here, but these will be discussed with you where applicable during estate planning.

Items that might be overlooked here:

- Present interests are eligible to be excluded only. If you’re gifting a future interest, the annual exclusion does not apply. The one exception to the gifting of a future interest is gifting to 529 plans where you can gift up to $75,000 to each individual and make the election to treat it as having been gifted $15,000 per year for a period of 5 years on a timely filed Form 709.

- Interest free loans and forgiveness of loans, especially when a related party is involved, are often viewed as gifts not deductible bad debt.

- Transfers of bonds, including those exempt from income taxes, are gifts

- Selling property outside of the ordinary course of business for less than it’s worth may be a gift or partial gift

- Having joint owners on your accounts where the joint owner is free to take money as they please, can be a gift

What does this all mean?

Should I be filing Form 709 annually and do I owe gift taxes?

Maybe and probably not.

The filing requirements will vary depending on your individual facts and circumstances but unless you’re gifting more than $15,000 per year to any one individual, you likely don’t need to file Form 709. If you are required to file Form 709, whether it be because you have taxable gifts or to make any applicable elections, it’s still unlikely that you owe tax presently. Presently is the key word here. Remember the applicable credit that we spoke about previously? Your lifetime transfers (gifts) are first applied against your lifetime applicable credit. If you’ve used all of your applicable credit through previous gifts then you’ll owe gift taxes presently, otherwise, your reduced applicable credit will be available to be utilized against any estate taxes upon your death or transferred to your spouse if the portability election is made.

Wait, we’re not finished yet. There is one transfer tax left that we need to consider. If you weren’t confused before you will be after dealing with the functionality, technicalities, and elections involved with the Generation Skipping Transfer Tax. Because of this, we won’t dive too deep beyond the general scope of what this tax is and why it exists. The generation skipping transfer tax (GSTT) is a flat tax, currently 40%, on transfers above the estate and lifetime gift exclusions where the recipient is one or more generations below the grantor, such as by a grandparent to a grandchild, or to an unrelated party more than 37 ½ years younger than the transferor. The theory behind this tax is to curtail the establishment of life estates that benefit infinite future generations by removing assets permanently from estate inclusion. The planning takeaway here is that the portability election between spouses of their unused estate and lifetime gift exclusions does not apply to the generation skipping transfer tax. Meaning without careful estate planning, if the first spouse to die does not utilize all their generation skipping transfer tax exemption then it is wasted. Don’t let this happen to you! if you plan on transferring any of your assets, in trust or otherwise, inter-vivos or after death, to a skip beneficiary, leave it up to your estate planning team to advise you accordingly on the appropriate strategy to maximize your exclusions and minimize transfer taxes.

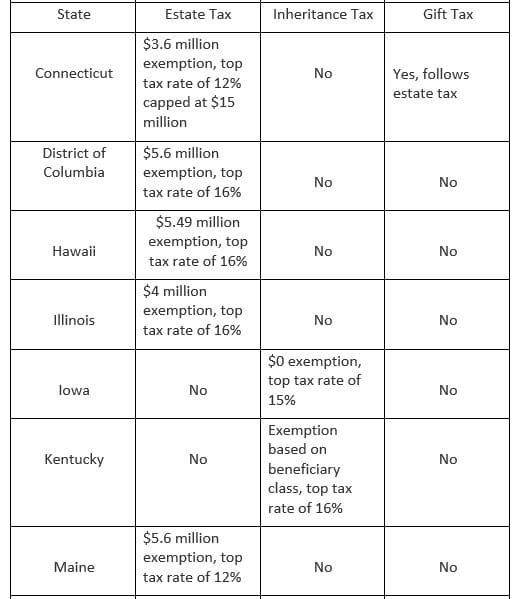

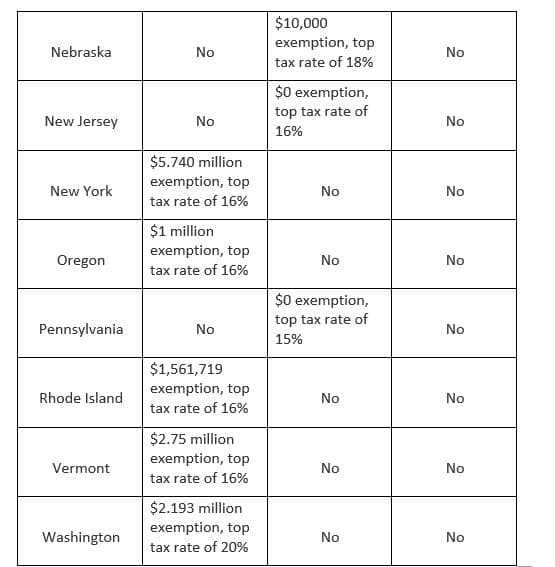

Planning for State Estate, Gift, and Inheritance Taxes

The Feds get most of the press but if you reside in or have assets located in a State that imposes estate, gift or inheritance taxes then the likelihood of your estate being impacted has drastically increased. In all instances, the State exemptions are lower than the Federal exemptions. We haven’t previously touched on inheritance taxes.While estate taxes are paid by the estate prior to the distribution of the assets to the beneficiaries, inheritance taxes are paid by the beneficiaries who receive the assets and the amount varies based on your relationship to the deceased (i.e. spouses don’t pay any inheritance tax, children of the deceased pay a low percentage, more distant relatives and other heirs pay the highest percentage, etc.).

As shown above, only Connecticut currently imposes a gift tax. This may further support the idea of a strong gifting strategy through 2026 to remove assets from your estate if you reside in one of the above States that imposes an estate or inheritance tax, but no gift tax.

Basic Checklist for Those New to Estate Planning:

- Will: names beneficiaries for the distribution of your assets, appoints an executor to your estate, names guardianship for minor children, does not avoid probate

- Durable Power of Attorney: designates who will handle your financial affairs and health care decisions in the event that you’re incapacitated. Terminates upon death.

- Power of attorney for health care: designates who can make medical decisions on your behalf if you’re incapacitated

- Living Will: Provides your wishes for life-sustaining measures if terminally ill.

- Revocable Living Trust: Allows for management and control of your assets during your life, avoids probate, allows for privacy, and designates beneficiaries

If you have any questions about Estate Planning, please contact us!