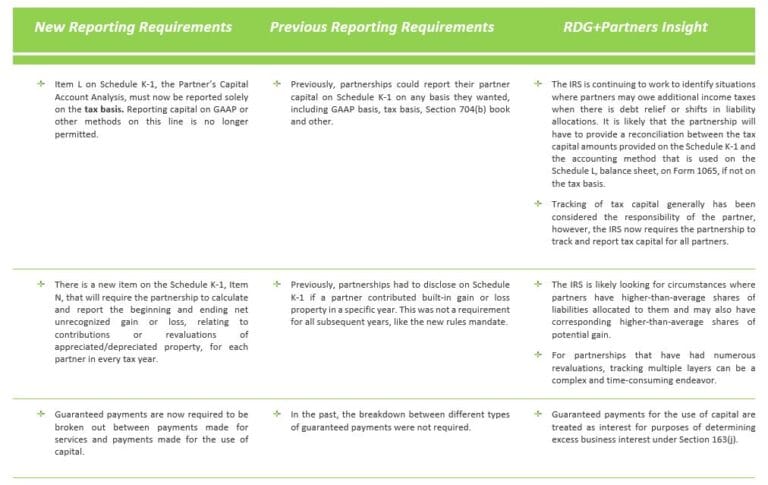

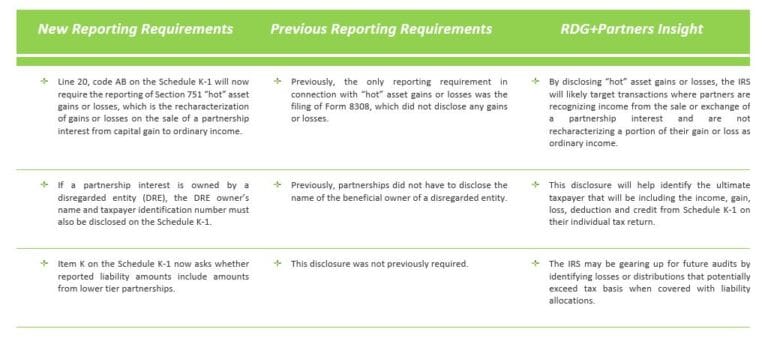

On September 30, 2019, the IRS released draft copies of the 2019 Form 1065 U.S.Partnership Return of Income and the 2019 Schedule K-1 (Form 1065) Partner’s Share of Income Deductions, Credits, etc. In an effort to make audit issues more easily identifiable, partnership returns now require that additional information be included on the tax return. Some of these disclosures can be particularly complex and will require more time and resources to ensure items are properly reported.

We are bringing this information to your attention to ensure all of our partnership clients will be in full compliance with the new tax forms and disclosures. We anticipate this may likely add significant additional time to the reporting process, and the changes should be discussed with your RDG+Partners tax advisor now to give us ample time to prepare and gather the information necessary prior to the filing deadline. While the forms and instructions are still in draft format, we believe the IRS is unlikely to make any substantial changes.

As reflected in the draft forms, the new required disclosures include: